Your Journey to Wealth and Health Security

Welcome to thewealthGuru.in, your friendly guide to smarter investing and secure health and Life coverage.

We specialize in Lumsum and Systematic Investment Plans (SIP) to help you build wealth step-by-step, and Insurance to protect you and your family.

Our approach is simple: empower first-time investors, salaried professionals, NRIs, and families with clear, trustworthy guidance. Start small, dream big, and let thewealthGuru.in be your partner in a financially secure future.

A Systematic Investment Plan (SIP) is an easy, disciplined way to invest in mutual funds.

You invest a fixed amount (even as low as ₹250 per month) at regular intervals (usually monthly).

Over time, these small investments grow through compounding, and you buy more units when prices are low and fewer when prices are high – a smart strategy called rupee-cost averaging that reduces the impact of market ups and downs.

In short, SIPs help you build wealth gradually without trying to time the market.

clients

works

Key Benefits of SIP Investing

Affordable & Beginner-Friendly

Start investing with a modest amount. No need to have a large lump sum – perfect for first-time investors and young earners.

Disciplined Savings Habit

SIPs automate your investments, making saving as routine as a monthly bill. This instills financial discipline effortlessly.

Rupee-Cost Averaging

Regular investments mean you average out your purchase cost. You buy more units in a mutual fund when the price is lower and fewer when the price is higher, smoothing out volatility over time.

Power of Compounding:

Your money earns returns, and those returns earn returns too! Over the long term, this compounding can significantly grow your wealth.

Flexibility:

You can increase, decrease, or pause your SIP at any time. No penalties – your investment plan adapts as your life changes.

“

“

Item Support

Debby Potts

“

“

Item Support

Debby Potts

“

“

Item Support

Debby Potts

1.Choose an Amount and Scheme

2.Auto-Debit Every Month:

3.Watch Your Wealth Grow

Why thewealthGuru.in for SIP?

Expert Guidance

Personalized Care

Online Convenience:

One-Stop Solution

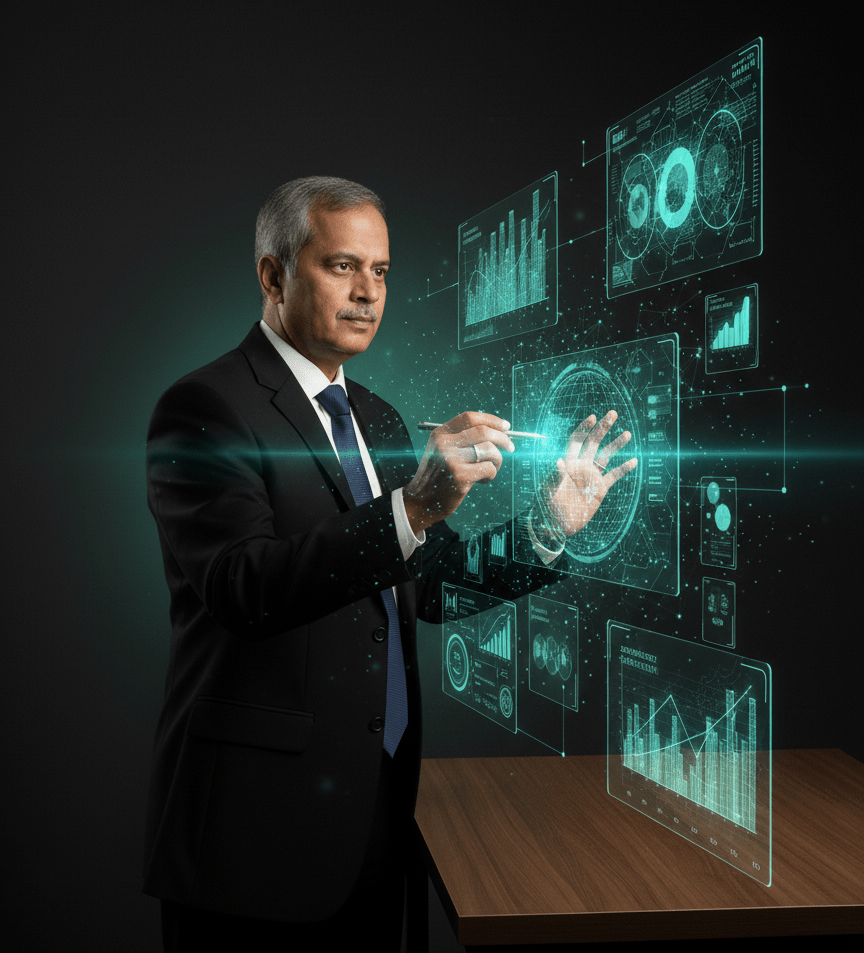

Protect Your Health, Protect Your Wealth

Medical emergencies can strike anytime and derail your finances.

That’s why we’ve partnered with Star Health Insurance, India’s leading health insurance provider, to keep you covered.

By combining SIP investments for wealth creation and health insurance for financial protection, thewealthGuru.in ensures you achieve your goals without worry.

clients

works